Inflation Reduction Act Examining Electric Vehicle Subsidies For Solar Panels. The new legislation, once passed, will provide a tax rebate of up to $7,500 for a new electric vehicle, which can be transferred to the car dealer so it can act as an. Here’s how to save on electric vehicles, solar panels, heat pumps, and more via tax credits and rebates.

A major goal of the inflation reduction act, the landmark climate legislation that passed the senate this week, and is poised to pass the house on. The inflation reduction act is expected to cut greenhouse gas emissions about 40% below 2005 levels by 2030, according to the new york times.

Environmental Protection Agency (Epa) Launched A $7 Billion Grant Competition Through President Biden’s Investing In America.

One of the many things this act accomplishes is the expansion of the federal tax credit for solar.

Here’s How To Save On Electric Vehicles, Solar Panels, Heat Pumps, And More Via Tax Credits And Rebates.

The inflation reduction act is expected to cut greenhouse gas emissions about 40% below 2005 levels by 2030, according to the new york times.

The Us Treasury Department Has Updated The List Of Eligible Electric Car Models.

Images References :

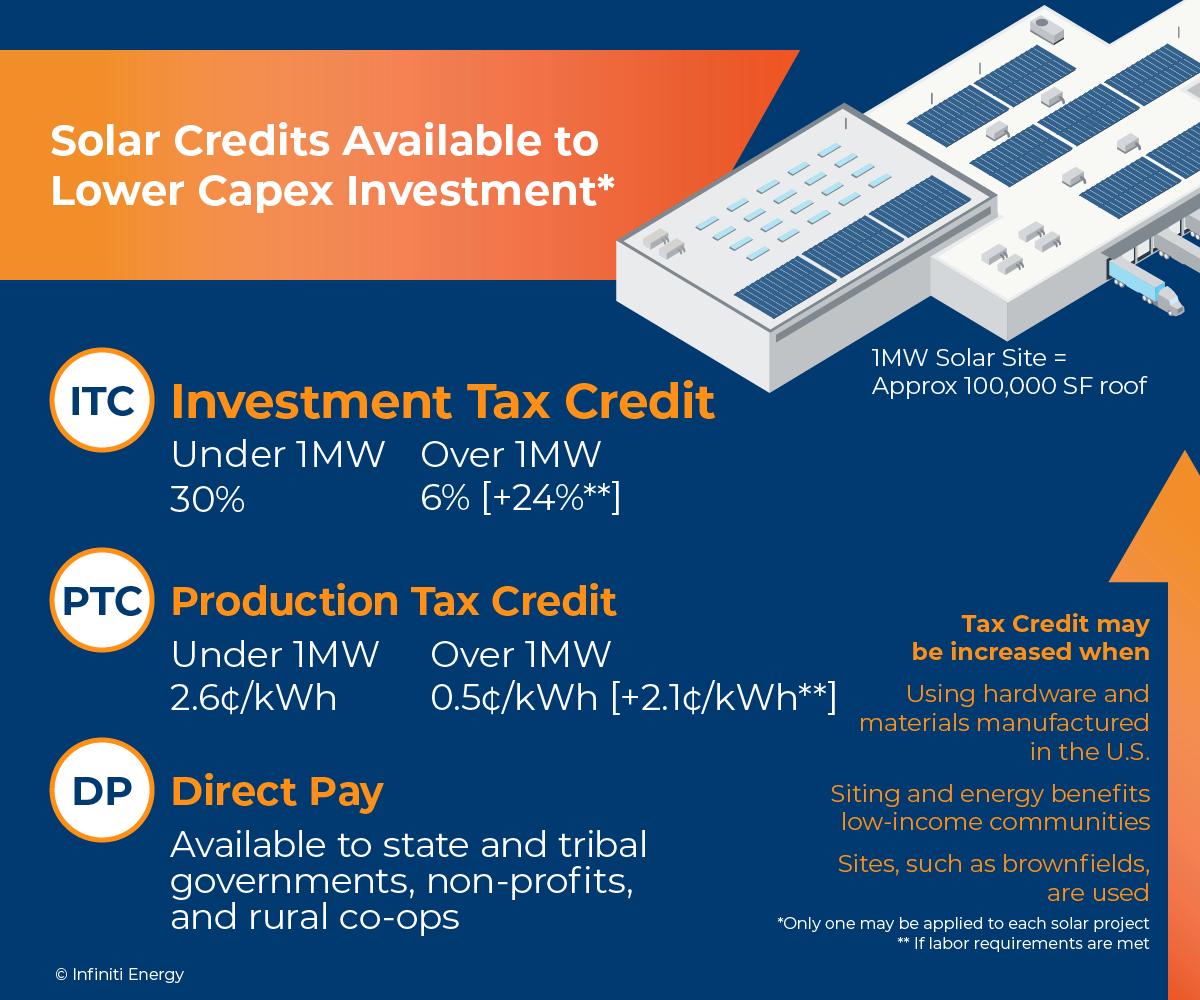

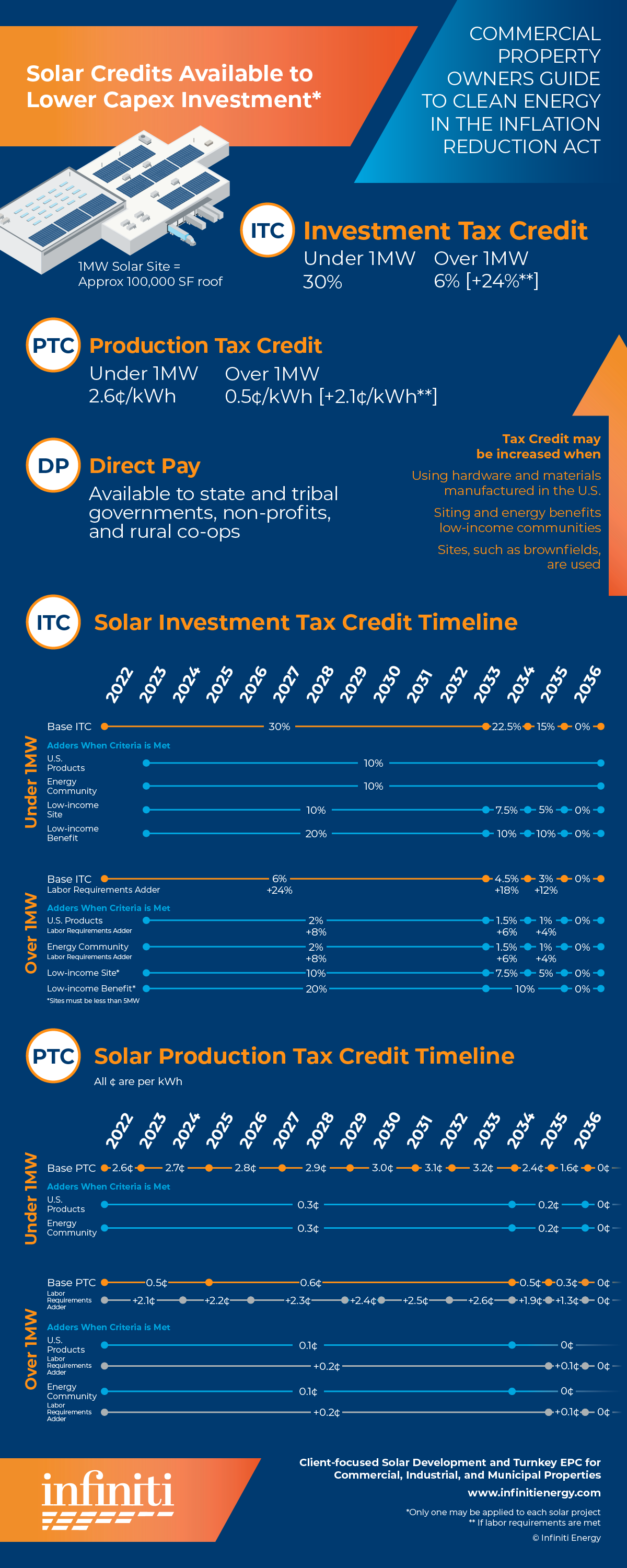

Source: infinitienergy.com

Source: infinitienergy.com

Clean Energy Incentives in the Inflation Reduction Act Infiniti Energy, One component of the inflation reduction act that is specifically interesting for those who wish to install solar energy in their homes is a key tax credit. For solar modules the credits are expected to include:

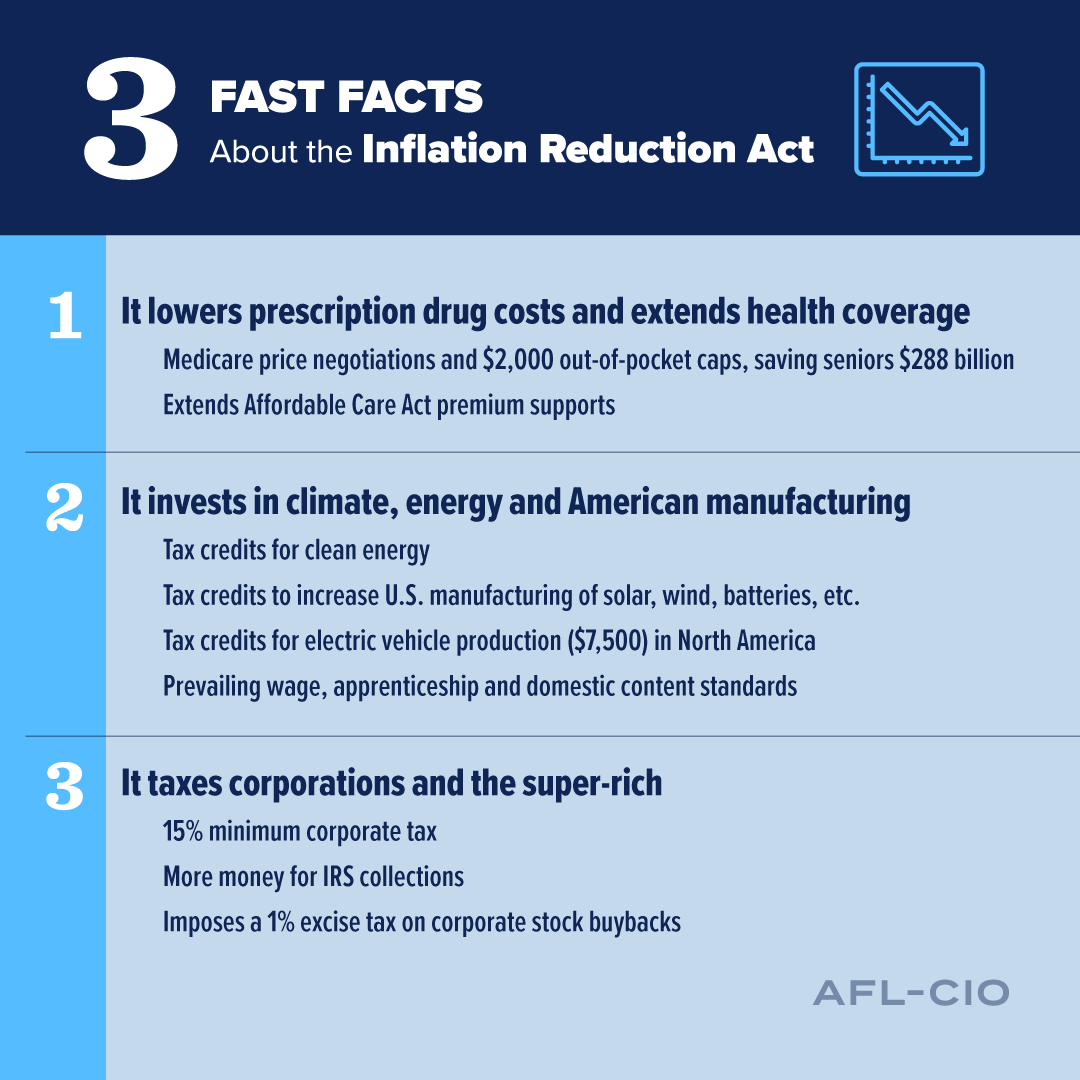

Source: aflcio.org

Source: aflcio.org

The Inflation Reduction Act Is a Victory for Working People AFLCIO, For solar modules the credits are expected to include: Updated on 5 june 2023.

Source: blog.ucsusa.org

Source: blog.ucsusa.org

What the Inflation Reduction Act Means for Electric Vehicles Union of, The inflation reduction act of 2022 is the most significant climate legislation in u.s. Simply put, the inflation reduction act includes a $7,500 tax credit at the point of sale for new evs and $4,000 for used evs.

Source: entegritypartners.com

Source: entegritypartners.com

Inflation Reduction Act Key Takeaways Entegrity Energy Partners, Environmental protection agency (epa) launched a $7 billion grant competition through president biden’s investing in america. The inflation reduction act, (the act or ira) signed into law on august 16, 2022 by president joe biden, will inject hundreds of billions of dollars into clean energy and.

Source: www.ourenergypolicy.org

Source: www.ourenergypolicy.org

How the Inflation Reduction Act Will Benefit U.S. Wind and Solar, History, offering funding, programs, and incentives to accelerate the. Ira provides a 30% tax credit for families investing in clean energy systems like solar electricity, solar water heating, wind, geothermal heat pumps, fuel cells, and battery storage for their homes.

Source: www.resources.org

Source: www.resources.org

Inflation Reduction Act Examining Electric Vehicle Subsidies for, The new tax credits replace the old. The new legislation, once passed, will provide a tax rebate of up to $7,500 for a new electric vehicle, which can be transferred to the car dealer so it can act as an.

Source: joinmosaic.com

Source: joinmosaic.com

4Step Inflation Reduction Act Guide, The us treasury department has updated the list of eligible electric car models. One of the many things this act accomplishes is the expansion of the federal tax credit for solar.

Source: infinitienergy.com

Source: infinitienergy.com

Clean Energy Incentives in the Inflation Reduction Act Infiniti Energy, For solar modules the credits are expected to include: Simply put, the inflation reduction act includes a $7,500 tax credit at the point of sale for new evs and $4,000 for used evs.

Source: tricountyair.com

Source: tricountyair.com

2022 Inflation Reduction Act Tri County A/C and Heating, It seems to be here: One component of the inflation reduction act that is specifically interesting for those who wish to install solar energy in their homes is a key tax credit.

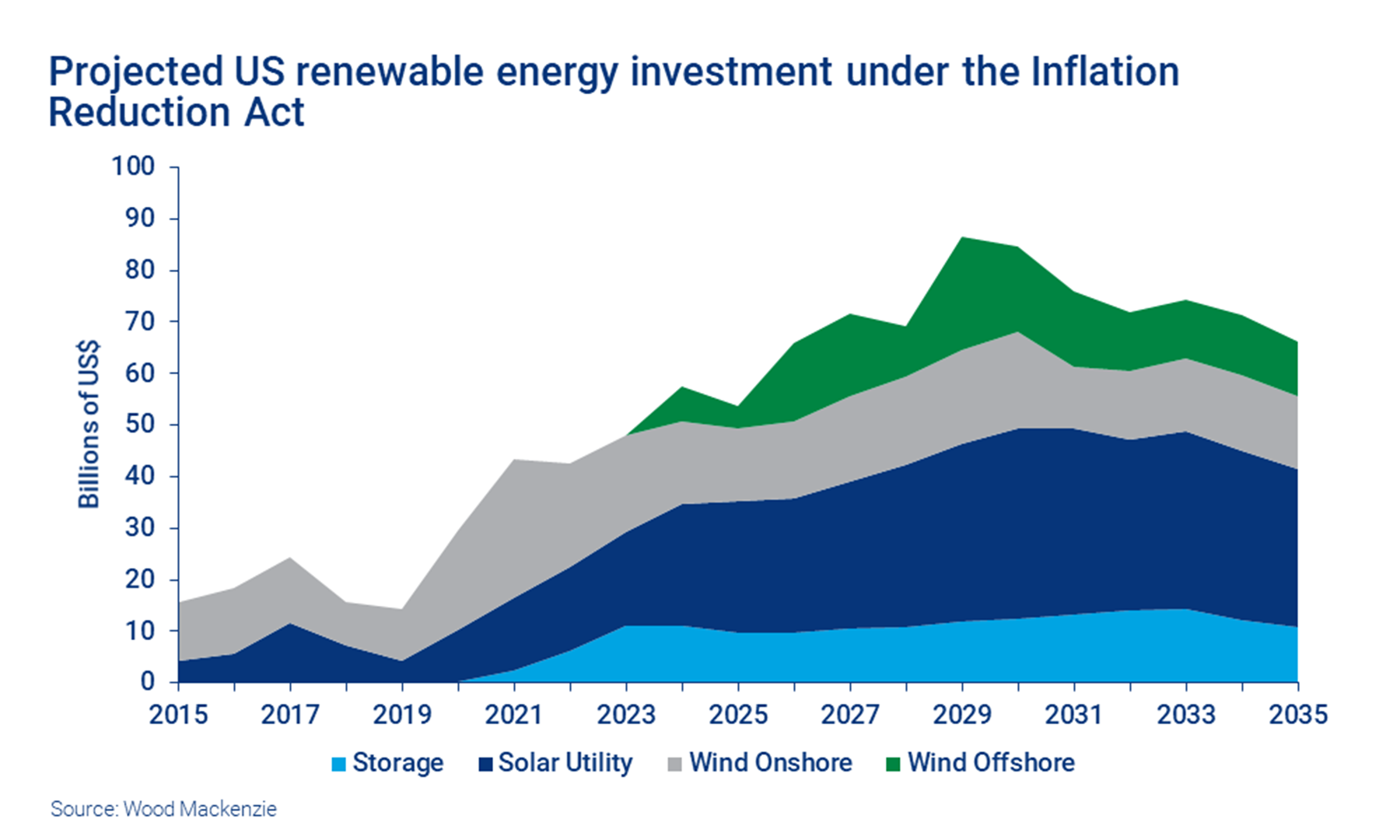

Source: www.woodmac.com

Source: www.woodmac.com

US Inflation Reduction Act set to make climate history Wood Mackenzie, The inflation reduction act of 2022 is the most significant climate legislation in u.s. One of the many things this act accomplishes is the expansion of the federal tax credit for solar.

“Given China’s Dominance Of The Solar Industry, Ira Solar Subsidies, Grants, And Tax Credits Could Be Used Extensively On Chinese Solar Panels And Solar.

The us treasury department has updated the list of eligible electric car models.

That’s One Of The Goals Of The $370.

Ira provides a 30% tax credit for families investing in clean energy systems like solar electricity, solar water heating, wind, geothermal heat pumps, fuel cells, and battery storage for their homes.