Income Tax On Social Security Benefits 2024. Only 10 states do or will continue to tax social security benefits in 2024. Earnings above that threshold aren't taxed for social security.

Social security beneficiaries are also set to see a slight uplift in their benefits. You will pay tax on your social security benefits based on internal revenue service (irs) rules if you:

Retirees Between 55 And 64 Can Deduct Up To $20,000 In Retirement Income.

As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the.

If You Are Already Receiving Benefits Or If You Want To Change Or Stop Your.

Federal income tax brackets and rates

The Rules Of The Internal Revenue Service Dictate That Many Who Receive Social Security Benefits Will Have To Pay An.

Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an. Social security payments are also subject to.

Source: taxfoundation.org

Source: taxfoundation.org

States That Tax Social Security Benefits Tax Foundation, File a federal tax return as an individual and your combined income* is. According to the house of delegates sent over a bill that would reduce the social security tax by 35% in 2024, 65% in 2025 and phase it out completely in 2026.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Source: www.investopedia.com

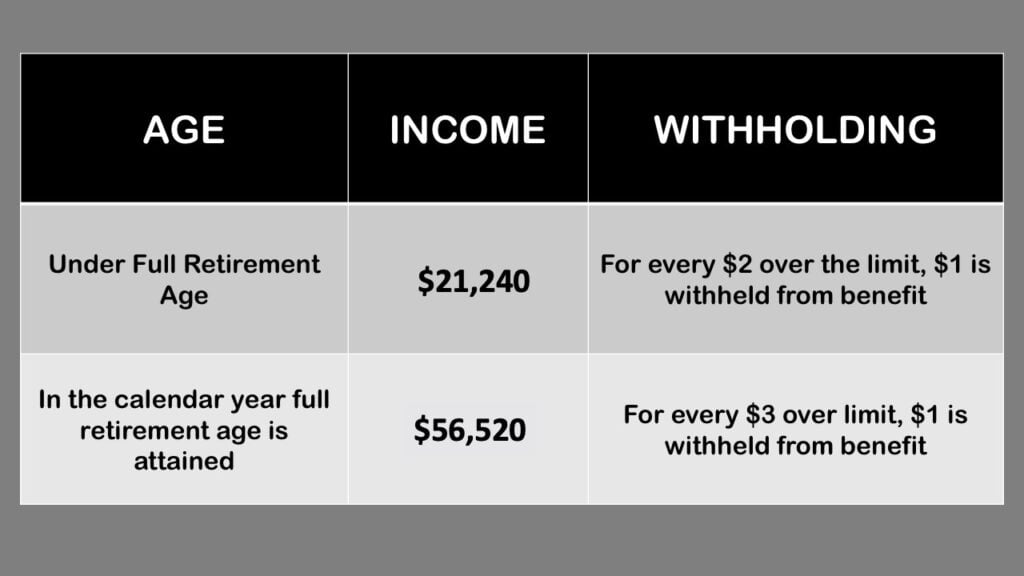

Source: www.investopedia.com

Paying Social Security Taxes on Earnings After Full Retirement Age, If you file a federal tax return as an individual and your income including social security benefits is between $25,000 and $34,000 you may have to include up to 50. In 2024, the threshold goes up to $168,600.

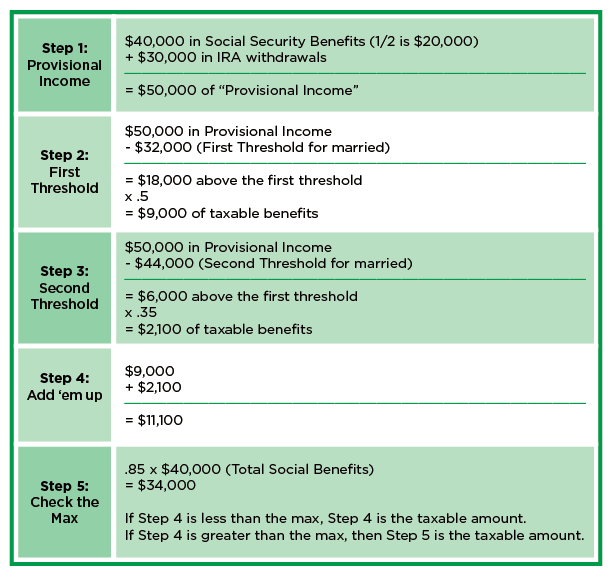

Source: www.covisum.com

Source: www.covisum.com

Taxable Social Security Calculator, Only 10 states do or will continue to tax social security benefits in 2024. If you file a federal tax return as an individual and your income including social security benefits is between $25,000 and $34,000 you may have to include up to 50.

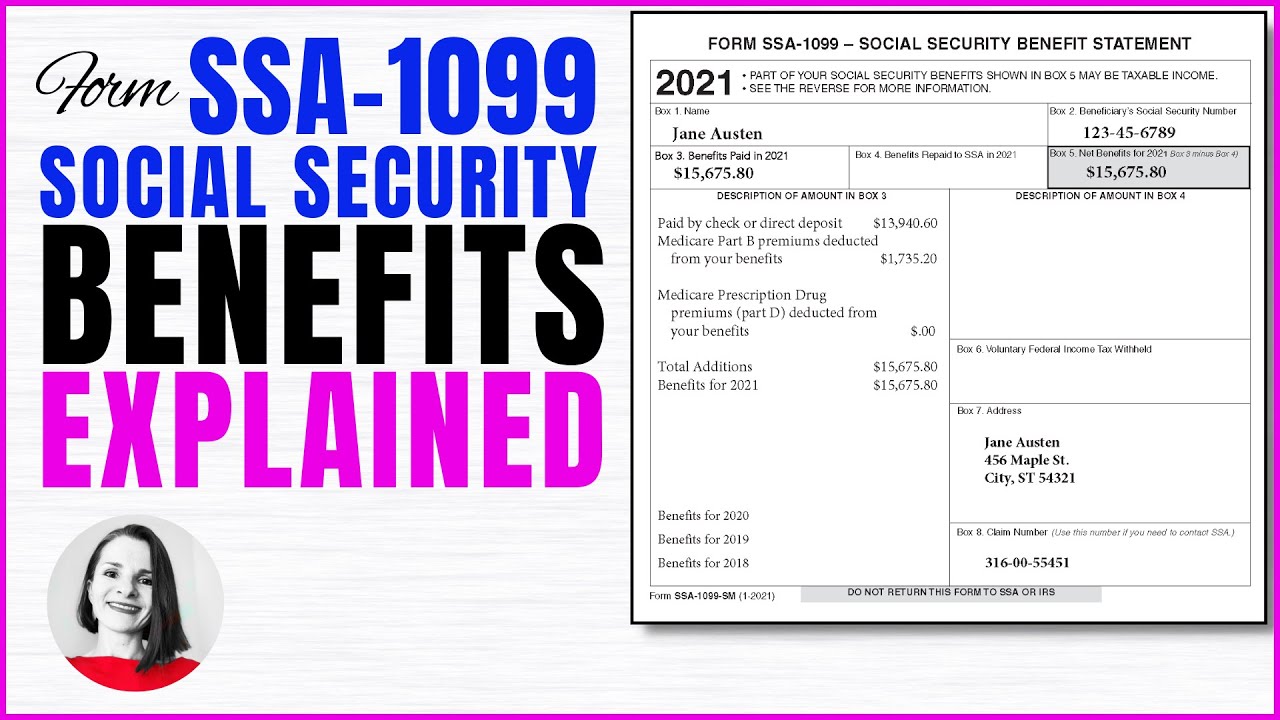

Source: www.youtube.com

Source: www.youtube.com

Tax Form SSA1099 Social Security Benefit Explained Is My Social, The answer depends on your gross income. If you file a federal tax return as an individual and your income including social security benefits is between $25,000 and $34,000 you may have to include up to 50.

Source: www.youtube.com

Source: www.youtube.com

How To Calculate, Find Social Security Tax Withholding Social, It’s estimated that 60% of retirees will owe no federal income taxes on their social security benefits, which may be why many believe social security benefits are. Social security payments are also subject to.

Source: www.cnet.com

Source: www.cnet.com

Tax Day 2024. You May Want to File Taxes Even if You Receive Social, It’s estimated that 60% of retirees will owe no federal income taxes on their social security benefits, which may be why many believe social security benefits are. The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an.

Source: mearaqmilissent.pages.dev

Source: mearaqmilissent.pages.dev

Ss Limits 2024 Nona Albertine, Retirees between 55 and 64 can deduct up to $20,000 in retirement income. Elimination of federal income tax on social security benefits.

Source: www.loftuswealthstrategies.com

Source: www.loftuswealthstrategies.com

What Is The Taxable Amount On Your Social Security Benefits?, Elimination of federal income tax on social security benefits. The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an.

Source: taxcognition.com

Source: taxcognition.com

Social Security Taxable Calculator Top FAQs of Tax Oct2022, The bill contains two main provisions: The states that tax social security benefits in 2024 are colorado, connecticut, kansas, minnesota, montana, new mexico, rhode island, utah, vermont.

Social Security Payments Are Also Subject To.

Retirees between 55 and 64 can deduct up to $20,000 in retirement income.

See What You Might Receive.

The states that tax social security benefits in 2024 are colorado, connecticut, kansas, minnesota, montana, new mexico, rhode island, utah, vermont.